[vc_row][vc_column][vc_column_text]Your NYC restaurant or bar has specialized bookkeeping needs. There are times when your business grows or expands beyond the point where you can be an effective manager or owner. It’s at this point when it no longer makes sense for you to personally manage your own books; it’s at this point where you need to educate yourself on what to look for when hiring an internal bookkeeper or outsourced bookkeeping company. It is essential to a company’s financial growth and success to have a daily real time account of current cash flow, so you can obtain immediate answers as per how much inventory (food and liquor) to purchase, how many people to schedule (based on sales) and how well your advertising or promotions are working. Many bookkeeping, controller and accounting responsibilities overlap and work in conjunction to ensure your restaurant is on track for success and profitability.

Here is your first question: does it make more financial sense to hire a full time in-house bookkeeper or outsource the duties to an accounting firm? What follows is a list of the areas, within the food and hospitality industry, with which a bookkeeper must be familiar.

Inventory and Supplies Budgeting

In a fast and busy environment among rapidly growing restaurants in Manhattan, more than one person may place orders for food and supplies. A financial controller or bookkeeper must be on top of monthly budgets to ensure that chefs or managers are not over purchasing because of a breakdown in communication. Also, it’s a good idea for the bookkeeper to periodically check the storage room to confirm that what was ordered in the record matches actual inventory figures.

Order and Receipt Reconciliation

One of your trusted employees or members of your outsourced team needs to make sure that the number of orders placed matches the  receipts. Importing daily sales data from your POS system into an accounting and bookkeeping software package can cover most of this reconciliation, but you still need someone to ensure that there are no errors or omissions after tallying the day’s receipts. You would be surprised how much money some restaurants lose by not collecting full payment on all customer food and drink orders!

receipts. Importing daily sales data from your POS system into an accounting and bookkeeping software package can cover most of this reconciliation, but you still need someone to ensure that there are no errors or omissions after tallying the day’s receipts. You would be surprised how much money some restaurants lose by not collecting full payment on all customer food and drink orders!

Sales Taxes

It’s imperative that your bookkeeper or firm maintain an accurate record of your restaurant’s sales tax obligations, and stay on top of actually paying the sales tax on time. You will want to find out from the bookkeeper how much you are actually paying each month.

Payroll, Payables and Vendor Payments

Your bookkeeper must handle and calculate FICA tips, payroll taxes, income tax withholding and the workers’ comp numbers in the restaurant’s general ledger. They must enter new employees and record the weekly time sheets into the payroll system. Also time cards must be checked to see if the employees are being paid the correct amount they have earned. Vendor invoices matter, your bookkeeper needs to be on top of reconciling the invoices with orders and also double check to see that their payments for services and supplies are accurate. Bills are reconciled and payments made on schedules to maintain good credit scores for the Restaurant’s management.

Your bookkeeper must handle and calculate FICA tips, payroll taxes, income tax withholding and the workers’ comp numbers in the restaurant’s general ledger. They must enter new employees and record the weekly time sheets into the payroll system. Also time cards must be checked to see if the employees are being paid the correct amount they have earned. Vendor invoices matter, your bookkeeper needs to be on top of reconciling the invoices with orders and also double check to see that their payments for services and supplies are accurate. Bills are reconciled and payments made on schedules to maintain good credit scores for the Restaurant’s management.

Deposits

At the close of each business day, the bookkeeper should prepare slips, which includes making sure the daily sales of checks, debit payments and cash all add up correctly. Contract or part-time bookkeepers typically check the bank receipts and maintain the totals in the general ledgers.

Budgeting and Forecasting

Budgeting and forecasting are two of the most important ingredients for business owners to run a profitable company. The purpose of this process is to establish a financial target that will help define the company’s direction.

Weekly Financial Reporting

A busy restaurant should have a weekly profit and loss statement report, breaking down sales, expenses and available cash. This report  should be analyzed to pinpoint any areas where the restaurant may be running over budget, or identify any areas where the restaurant is hemorrhaging cash, so that you can update your operational controls, if necessary. Other financial reports which have also been found to be useful are the income statement, balance sheet and cash flow statement.

should be analyzed to pinpoint any areas where the restaurant may be running over budget, or identify any areas where the restaurant is hemorrhaging cash, so that you can update your operational controls, if necessary. Other financial reports which have also been found to be useful are the income statement, balance sheet and cash flow statement.

A more comprehensive list of bookkeeping and accounting responsibilities necessary to a restaurant’s financial health can include:

- Managing day-to-day accounting operations.

- Managing general ledger accounting including accounts payable, accounts receivable and inventory.

- Preparing timely and accurate monthly, quarterly and annual financial statements, including balance sheets and profit and loss reports.

- Creating and preparing management reports, including financial outlooks and forecasts.

- Maintaining inventory and cost accounting records.

- Ensuring all internal accounting processes are timely and accurately completed.

- Assisting with budgeting processes.

- Preparing tip reporting 8027

- Approving and coordinating changes and improvements in automated financial and management information systems.

- Conducting periodic reviews of financial procedures and making progressive recommendations for changes and/or improvements.

- Supporting tax-return preparation including federal and state tax reports and payments and other tax returns, including 1099 forms.

- Preparing schedules and providing records to auditing firms.

- Posting adjusting entries and closing the books at year-end.

- Maintaining required records, reports and files in an organized manner.

Full Time Employee vs. Outsourced

Any restaurant owner looking to grow and expand should not be spending time on daily bookkeeping duties or handling vendor issues. These tasks are considered to be more of the back office sort and will take time away from other crucial decisions (revenue generating activities, purchasing, and managing employees, etc) that go with running a restaurant in the bustling big city.

Any restaurant owner looking to grow and expand should not be spending time on daily bookkeeping duties or handling vendor issues. These tasks are considered to be more of the back office sort and will take time away from other crucial decisions (revenue generating activities, purchasing, and managing employees, etc) that go with running a restaurant in the bustling big city.

The In-House Employee

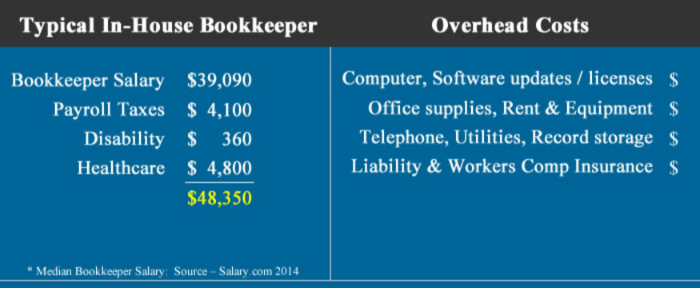

You have to weigh the pros and cons of outsourcing or hiring a full time in-house bookkeeping employee. Let’s take a look at some of the details that come with hiring a full time employee. First, you are adding an employee to the payroll and having to provide a desk or office space. You then have to calculate the cost of wages, benefits, retirement plans and taxes, overhead, and time and effort. As a note, overhead costs are comprised of equipment, office space, supplies and other items needed for the employee to perform respective job duties. All this, with the addition of the time and effort it takes to hire, train and manage the accountant (onboarding), can ultimately amount to a hefty sum. Because this can be expensive, and considering how razor thin profit margins are in restaurants, this might not be the best use of capital deployment. The average salary of a full time bookkeeper is around $39,090. The following items must also be considered:

- Payroll taxes $4.100

- Disability $360

- Healthcare $4,100

- Vacation/Sick Days ???

- Placing Ads, Screening Interviews, Testing and Training of Employees ???

- Extra overhead costs ???

The Outsourced Bookkeeper

The Outsourced Bookkeeper

Restaurant owners shouldn’t be burdened overseeing the daily bookkeeping and having to deal with vendor issues. It takes time away from the never ending details of running a restaurant. If you choose to utilize a highly knowledgeable outsourced bookkeeping and accounting company to handle all these financial tasks, it can yield your restaurant greater control and accountability. This is all while you are being provided with an impartial third party financial insight, free of any conflict of interest. Outsourcing helps reduce the risk of fraud associated with your business’ accounting because there is a separation of duties and more rigorous steps taken when providing financial statements for the business.

When you decide to outsource, you will recognize that there are no hidden costs. As a client, you will simply pay a predetermined monthly fee depending on a decided plan that makes the most sense for your business. Outsourced accounting firms take advantage of the latest advances in automation cloud technologies and industry best practices, which can eliminate the need for you to provide benefits, pay overhead costs or devote the extra time and effort necessary to hire and manage a new employee. Cloud bookkeeping software with digital apps help you quickly turn random invoices and sales slips into digital documents ready for processing. Growing independent restaurant chains should be creating innovative cuisine and customer experiences, not building accounting departments.

When you decide to outsource, you will recognize that there are no hidden costs. As a client, you will simply pay a predetermined monthly fee depending on a decided plan that makes the most sense for your business. Outsourced accounting firms take advantage of the latest advances in automation cloud technologies and industry best practices, which can eliminate the need for you to provide benefits, pay overhead costs or devote the extra time and effort necessary to hire and manage a new employee. Cloud bookkeeping software with digital apps help you quickly turn random invoices and sales slips into digital documents ready for processing. Growing independent restaurant chains should be creating innovative cuisine and customer experiences, not building accounting departments.

Partnering with Bookkeeping Chef frees up and allows restaurant managers to focus on strategy, customer service, operations and ultimately increasing profits. From the “back of the house” to the “front of the house”, improve operational efficiency with accounting software services, solutions, applications and tools tailored to your restaurant hospitality industry.[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][mk_button dimension=”flat” size=”x-large” bg_color=”#ffa500″ url=”https://bookkeepingchef.com/request-a-quote/” target=”_blank” align=”center”]Request a Consultation [/mk_button][/vc_column][/vc_row]

4 Responses