Are you opening a new franchise or independent restaurant in New York City? Well, one of the cornerstones of starting any new restaurant business is making sure you have proper back office operations in place, which would include having the latest accounting and bookkeeping systems set up and configured. Bookkeeping and keeping records for accounting is different from other brick and mortar retail industries because the use and purchase of products and inventory does not alway come prepackaged. So in order to stay on top and and track all the different financial aspects of your new restaurant, which includes profit and loss statements, cash flow management, daily sales, prime cost, payroll, labor and food costs, it’s vital to update bookkeeping records on a daily ongoing basis in order to ensure profitability. Starting and managing a restaurant is exciting, but it often comes with an endless to-do list.

Here is New Restaurant Opening Back Office Operations Checklist Guide

1 You must track and record your food and liquor inventory. Being the largest initial purchases even before your grand opening, it is important to know exactly how much food and liquor you initially purchased. In the aspect of managing your new restaurant’s bookkeeping, it’s recommended to record the date and list each inventory item purchased along with its cost. Then you can go ahead create a space in your bookkeeping software system, that allows you to make daily entries to record each day’s food sales, food purchases and the food cost-ration, along with a daily running total of each. Create a similar inventory for your bar and liquor items as well.

2 You need to create a worksheet that records your food sales. In this worksheet, list the number of meals that you serve during different meal periods — like breakfast and location of the meal — such as the bar or dining room. Next, to each item, you will want to create a space to record the amount of money you earned during each meal period and the amount of sales, you made in each location of the restaurant. It is recommended that you record these numbers into the software on a weekly if not daily basis.

3 Now you will want to do the same thing for recording all of your beverage sales. Using the similar worksheet template you created in step 2, record your beverage sales by drink type instead of meal period. Drink types include beer, soft drinks wine and cocktails. It is a good idea to fill out or input the data on a weekly or daily basis.

4 Next, you will want your outsourced bookkeeping company or inhouse bookkeeper to prepare a summary software worksheet template that should be filled out on a daily basis once your restaurant opens. In the old days, they would use one per register. This summary journal entry should include the dollar amount of coins, checks, cash, gift cards and all debit/credit card transactions made. You can categorize the credit transactions by the credit card company names. If applicable, include an area to record the amount of sales tax collected, adjustments to meal prices to take into account. It also is recommended to create an area to account for tips charged to credit cards. Before the restaurant officially opens, each register should contain cash for servers to use for change. Make sure you compare the initial amount of cash in the till against the remaining amount left at the end of the night and note any differences or discrepancies.

5 Next, you need to create a sales and cash receipts worksheet to fill out on a daily basis and total at the end of each month. In this worksheet, you will create space for to input the total food sales, drink sales, the sales tax collected on each, tips charged, and other relevant receipts. You can also choose to get even more granular by breaking it down into specific types of food and beverage sales.

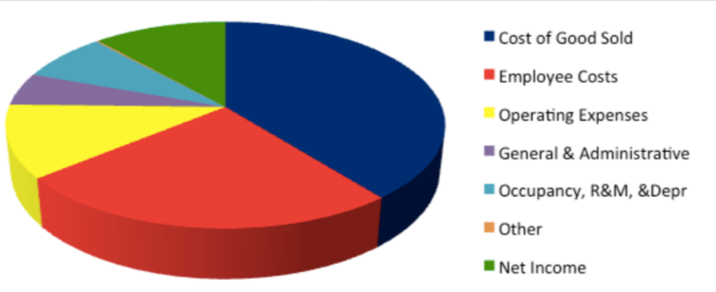

6 You must also keep track of all your restaurant’s operating expenses so you can calculate your income statement. In addition to the cost of food and liquor inventory, you also need to account for other operating expenses such as rent, employee wages and benefits, marketing, insurance, utilities, hr /administration expenses , depreciation, loan payments, startup costs, and any repairs/maintenance costs. You will create space to take into account the operating income earned, income before taxes and income taxes. Calculate your total monthly expenses in each category and then add all of the categories to calculate your overall monthly expenses. Subtract your expenses from your revenue to determine net profit.

7 A break-even analysis report is necessary to be created. Using the financial information from the operating expenses, you need to calculate the amount of time it takes for you or any investors to break even with your restaurant’s startup costs. Also, it is recommended to list all potential financial risks you may encounter and solutions to lessen or eliminate the risks.

8 Cloud accounting and bookkeeping software technologies have changed most of the steps mentioned earlier in the checklist. This technology offers a higher level of automation, collaboration, accuracy, convenience and efficiency to assist the back office operations. The best accounting software will connect with your POS system. It will also be able to track sales by each server while monitoring food, bar, and gift certificate sales So that the steps mentioned in 2 and 3 will not have be manually inputted each day. Also, your restaurant’s cash flow will be determined and scrutinized. It is necessary to reconcile your bank and credit accounts. This process can be done automatically, which gives you 24/7 access to your financial data on any device so that you can make better financial and business decisions and know if your business is in the black or red.

Challenges

If you want your restaurant opening and operations have gone off without a hitch, including that accounting and bookkeeping matters were well organized from day one. Then you are going to have restaurant bookkeeping experience and have working knowledge of using integrated bookkeeping, accounting, bill pay, payroll and cash management software systems. You also will need all of these accounting records or books in order to file and pay taxes, and understand the financial workings of your business.

Tip

Now if this is not your first restaurant venture or you have an accounting background, you could in theory attempt to juggle running your actual restaurant and the bookkeeping on your own. But it may be best to hire the services of a professional accounting & bookkeeping firm who already has proven restaurant bookkeeping experience.

Bookkeeping Chef’s provides restaurant-specific accounting and bookkeeping for independently-owned restaurants in NYC and throughout the United States.