Boosting Profitability Hinges on Calculating and Controlling Prime Costs

For New York City restaurants, driving profitability goes beyond just increasing total sales. Savvy operators also zero in on minimizing expenses to truly impact bottom-line performance.

The key focus area is prime cost – typically a restaurant’s two largest expense categories. Gaining visibility into prime cost calculations unlocks insights for controlling these major line items. With a grasp on prime costs, owners can pinpoint operational inefficiencies and implement strategies to enhance overall financial health.

By keeping a pulse on prime cost percentages compared to benchmarks, restaurant leadership can course correct before costs spiral. Regularly analyzing and optimizing this critical ratio represents a valuable lever for maximizing profits amid the inherent volatility of the industry.

Rather than chasing top-line growth alone, restaurateurs must make prime cost management a top priority. Vigilantly monitoring and reining in these major expenses paves the way for sustainable profitability gains that extend beyond just boosting revenues.

The dream of owning a New York City restaurant is realized in that moment when everything works together: the menu, world renowned chef, the staff, the patrons. But more often than not, that really is just a moment. The rest of the time? There isn’t enough tilapia for Taco Tuesday…

The ice machine stopped working…and your top three waiters have just called out…I mean, let’s face it… running a restaurant is more organized chaos than well-oiled cash machine.

It can seem like there are so many factors beyond your control when it comes to keeping your business’ doors open. So how does a restaurant manager maintain some sense of order (and sanity)? The answer is in your restaurant’s prime cost – just managing and maintaining this number will ensure your restaurant stays running… and give you the control to manage the most important aspect of your business.

What is Your Biggest Bookkeeping issue?

- Are you behind on your books?

- Not sure where your cash flow is going each month?

- Need help with financial reporting and actionable analysis?

- Having problems or inaccuracies with your accounting systems?

- Need help with getting food and labor costs in control?

No problem we have seen it all, questions like these can keep even the best restaurateurs and chefs up at night. No problem we have seen it all, questions like these can keep even the best restaurateurs and chefs up at night.

WHAT IS PRIME COST EXACTLY?

First things first. Let’s define what prime cost is. Simply put, it’s an equation you can use to manage your profits and make sure your business… well… stays in the black. Here’s the formula:

COST OF GOODS SOLD (COGS) + TOTAL LABOR COST = PRIME COST

If you’re not a fan of math equations, there’s a simpler way to look at it. Prime cost includes those things you pay for on a day-to-day, week-to-week, month-to-month basis that keep your restaurant running. Basically, it’s the products and people power needed to keep you in business.

What are Some Items that Prime Cost Doesn’t Include?

- A broken dishwasher needing repair

- New chairs for the dining room

- Rolls of paper towels and toilet paper for the bathroom

- A new sandwich board for your front sidewalk

- An air conditioning bill

- Labor day party decor

Now that you understand what prime cost is, you’re probably wondering what yours should be.

WHAT’S A HEALTHY IDEAL PRIME COST NUMBER?

The prime cost of a thriving restaurant should be approximately 60% (or less) of your total food and beverage revenue.

You’re probably thinking, “So I just add up the inventory that sold and what I paid my servers… and I’ve got my prime cost. And if that adds up to be less than 60% of all of my sales, I’m good. Right?”

Maybe. If you’ve calculated your COGS carefully and included what you’ve paid employees in addition to the costs that come along with running payroll in your prime cost…you might be good.

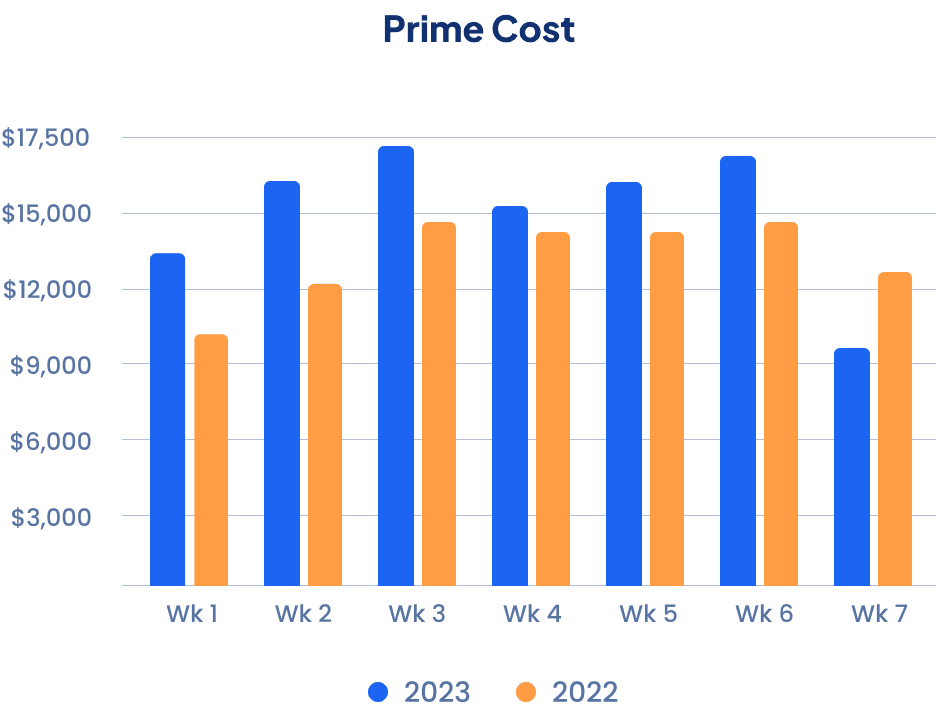

And if you’re figuring your prime cost on a consistent and frequent basis, you might be better than good. If you’re comparing your prime cost from day to day or week to week and making adjustments either in inventory or people power based on your analysis, we bet you’re on the right track.

Remember it’s your total cost of goods sold (to be calculated properly requires weekly or monthly inventories to calculate use because purchases divided by sales are NOT accurate), plus your total labor cost, including taxes, benefits and insurance, all divided by your gross sales (sales before discounts, not including sales tax).

But before you pat yourself on the back and move on in your to-do list, let’s be crystal clear about the importance of figuring out your prime cost.

WHY IS PRIME COST IMPORTANT?

“Because It’s The 1 Number You Must Know to Make Money in Your Restaurant” – Scott Aber

In this video, David Scott Peters, a restaurant management consultant does a pretty good job of explaining why your prime cost number is so crucial. As a restaurant manager, you hold a good portion of the fate of your business in your hands. Sure, you’ve got your hands full with servers, schedules, menus, and orders. Stuff falls through the cracks every day. But the most important tasks for your business are to get an accurate COGS, keep a close eye on labor costs and compare your prime cost from week to week. Simply gathering these numbers is not enough, though. You’ve got to use this data to drive how you schedule your servers and what you put on your menu in order to make your budget goals. Letting a few hours of payroll slip through the cracks once may not close your doors, but consistently paying more than you need to for hourly wages could certainly put a dent in your profits.

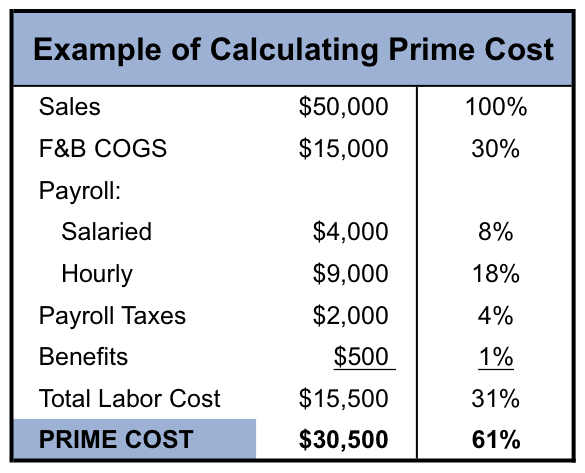

HOW DO I CALCULATE PRIME COST?

It’s not hard to add up your prime cost on a consistent basis. In fact, the more you do it, the faster you’ll become at it. Let’s walk through it step by step…

#1 COST OF GOODS SOLD (COGS)

Your COGS represent the total cost of all product that left your restaurant in a week. So to figure out your COGS, start by taking an accurate inventory of your storeroom, walk-in, and bar. Let’s say you do that and wind up counting $10,000 in inventory.

Then after running your restaurant as usual for a week… take the inventory again and add in any inventory purchases you made during that time. Let’s say you received a delivery worth $2,000 midweek. And when you took your end of-week inventory, your count was now at $8,000.

You now have all the numbers you need to calculate your COGS: Starting inventory ($10,000) + purchases ($2,000) – ending inventory ($8,000) = COGS ($4,000) If this seems over complicated and time-consuming… you’re right.

Nowadays, simple apps complete all these calculations for you… so you don’t have to lift a finger. Once COGS is taken care of, you’re halfway to figuring out your prime cost for the week. The second step is figuring out labor costs.

#2 LABOR COSTS

Varying industry standards put labor costs between 30 to 35% of a restaurant’s total sales. The majority of labor costs stem from paying employee wages and salaries. To obtain a more accurate picture of a restaurant’s labor costs, divide the front-of-the-house labor with the back-of-the-house. Front-of-the-house labor includes wait staff, floor managers, hosts, bussers, and bartenders. Back-of-the-house includes chefs, kitchen staff and dishwashers.

If you’re keeping track of labor costs by adding up the total wages your employees have earned in a week… you’re off to a good start. Keep in mind your labor costs must also include:

- Payroll taxes

- Workers’ compensation insurance

- Employee health insurance (if applicable)

- Any additional employees benefits you offer

If you’re using technology to schedule your employee shifts, this information should be easily accessible. Your accountant will most likely have this number, too

An important labor cost note… be sure to differentiate between salaried wages and hourly wages. This information may come in handy when you’re using your prime cost to make important decisions about cuts to your budget and the financial health of your restaurant. When it comes to labor costs, we recommend that its percentage of revenue be calculated daily. Yes, that’s right, daily! It isn’t that hard to set up your restaurant bookkeeping system to do this.

#3 PRIME COST

Once you’ve got your COGS number and labor cost number… you’re ready to roll. Here’s our handy equation for calculating prime cost:

COGS + LABOR COSTS = PRIME COST

So what do you do with this prime cost number? Back it up against your total sales for the week. So, if your prime cost comes out to $7,500… you’d divide that by your total sales for the week (let’s say you made $12,000) to get a percentage:

Total COGS ($4,000) + Total Payroll ($3,500)

_________________________________________ = 63%

TOTAL SALES = $12,000 x 100

In the above case, you’d need to do some trimming either in food cost or labor. Specifically, you might look for hidden food costs or take a look at the schedule to see if you really need four hourly servers on at lunch on Tuesday.

Remember, knowledge is power. When you know your prime cost, you have valuable knowledge to guide your further decision-making.

Prime Cost Formula Calculator:

- Total Sales ____

- Starting Inventory ____

- Purchased Inventory ____

- Ending Inventory ____

- Hourly Wages ____

- Salary Wages ____

- Workers Comp ____

- Employee Health Insurance ____

- Other Employee Benefits ____

- Payroll Tax ____

WHEN SHOULD I CALCULATE PRIME COST?

It may seem like a lot of what happens in your business is out of your control. But the one thing you have the ability to control is your prime cost. That’s why you should be tracking it consistently and often.

If you ONLY calculate your restaurant prime cost once a year, you ONLY get a snapshot of the health of your business at that point in time. And unless you do something with the information you’ve collected… you’ve pretty much wasted your time… you’ve missed week-by-week and month-by-month opportunities to adjust your food costs or trim your labor costs to increase your profits.

A lot that can happen week to week… and often day to day… that can affect your prime cost.

WHAT TO DO WHEN YOU HAVE A BAD PRIME COST

If you’ve calculated your Prime Cost and it’s above 60%… what do you do? First, you’ve got to figure out the cause so you can make changes immediately.

It could be people problems.

This includes improperly trained employees who don’t follow portion control guidelines… managers who over staff shifts… employees who steal inventory.

Or it could be your food costs.

Some food costs increase because of seasonality or availability. But a lot of the time… your food costs go up for no logical reason at all. When you see this happen… it’s time to talk to your supplier. Even if they’ve promised you “a deal” or special pricing… there’s no way to know if you’re actually getting a good price. And when food costs make up 1/3 of your spend, you better believe you want to get every penny’s worth.

One mistake restaurant operators make sometimes is knowing that food and beverage cost and labor cost work together to comprise prime cost, but failing to remember all the elements that make up the prime cost.

So within food and beverage costs, you also need to consider things like paper supplies, condiments, and frying oil—basically, anything included in the cost of goods sold. Similarly, for labor, it is not enough to just add your payroll; consider taxes, benefits, and insurance as well. Adding every appropriate cost will give you a more conservative and more accurate number to use.

Conclusion

It all starts with an annual budget which allows you to easily see what needs to be done to achieve these kinds of numbers and then proactively apply systems that change your operation to achieve those numbers. Your budget will ultimately determine where your costs should be. Another caveat: In order to have an accurate prime cost number you must be on an accrual accounting system. Bookkeeping Chef can show you how to calculate prime cost at the end of the month on your Profit & Loss Statement which includes prime cost as line item number. The most profitable NYC restaurants I’ve ever worked with all track their prime costs on a weekly basis. Request a free consultation.