[vc_row][vc_column][vc_column_text]

Do you Own a Restaurant in New York City Tri-state Area?

New York State sales-tax officials are turning up the heat on restaurateurs, auditing 40% more of the city’s eateries during 2017 than in 2016. This fact has left the restaurant industry with a case of agita.

New York State sales-tax officials are turning up the heat on restaurateurs, auditing 40% more of the city’s eateries during 2017 than in 2016. This fact has left the restaurant industry with a case of agita.

The New York Tax Department estimates that it loses billions in tax revenue owed but not collected each year; this is referred to as the “Tax Gap”. Bookkeeping Chef can help advise and assist your business if you have been selected for a sales tax audit. Many bars, nightclub, and restaurant owners feel that meeting a sales tax auditor is nerve racking, confusing and frustrating. The New York State Department of Taxation and Finance audits, investigates, and collects taxes from businesses to help ensure that all New Yorkers pay their fair share of taxes. If you’re audited, they may bill you for additional tax, penalties, and interest; deny a refund or credit you claimed, propose a refund; or make no change at all.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][mk_button size=”x-large” url=”https://bookkeepingchef.com/request-a-quote/” target=”_blank” align=”center”]Get Started Today [/mk_button][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]Primarily, this is due to the fact that New York State perceives the bar and restaurant industry to be an ideal target for sales and use tax audit. While this is no surprise, there are several reasons, including:

- Significant cash based transactions;

- High percentages of theft of liquor, spillage, spoilage; and

- relatively unsophisticated accounting systems.

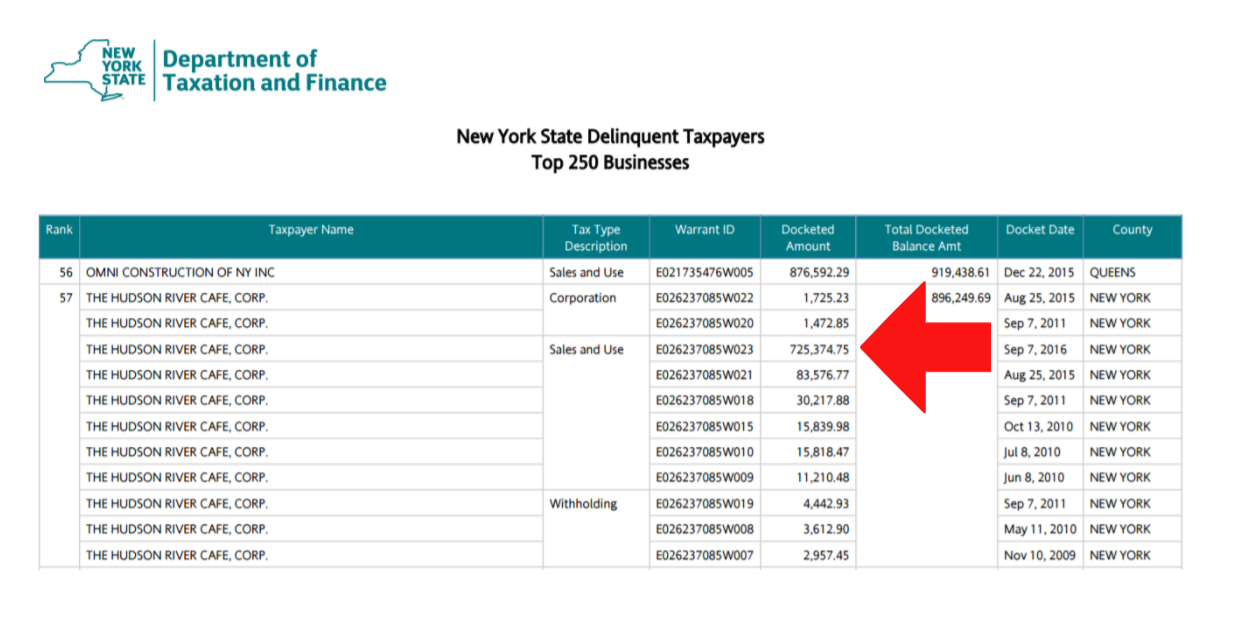

The sales audit of a restaurant is much more common than most people seem to realize, and it’s more potentially dangerous to your business than you think. Couple this with the fact that not all restaurateurs and experts are up to date on sales tax laws and how sales tax audits are conducted in New York state. Here is a list of 250 NYC businesses that are under delinquent sales tax audit collection. Don’t let this happen to your company.

Bookkeeping Chef can give your restaurant a free analysis and walk you through the sales tax audit process. Our trained bookkeepers and CPAs have years of experience working with auditors and audits that have been conducted on restaurants. We understand how to help restaurants that receive a large portion of their sales revenue in cash, and the necessity to understand the requirement to keep every single guest check, sales slip and register tape. Certain circumstances that could have an effect on a company, such as a renovation, seasonal variation and lack of a solid bookkeeping system, are widespread norms which even auditors may not be aware of. Some NYC restaurants have even been asked to go through every transaction on a credit card bill issued to a tax-exempt company and provide verification that the purchase was, in fact, for that tax-exempt organization.

Bookkeeping Chef can give your restaurant a free analysis and walk you through the sales tax audit process. Our trained bookkeepers and CPAs have years of experience working with auditors and audits that have been conducted on restaurants. We understand how to help restaurants that receive a large portion of their sales revenue in cash, and the necessity to understand the requirement to keep every single guest check, sales slip and register tape. Certain circumstances that could have an effect on a company, such as a renovation, seasonal variation and lack of a solid bookkeeping system, are widespread norms which even auditors may not be aware of. Some NYC restaurants have even been asked to go through every transaction on a credit card bill issued to a tax-exempt company and provide verification that the purchase was, in fact, for that tax-exempt organization.

Now that we’re working with Bookkeeping Chef, we have a proven system that makes certain that we are charging the correct amount of sales tax to every customer throughout our restaurant chain operations. We have reduced the chance that we will be selected for a tax audit, reduced the cost of complying with tax audits, and greatly reduced the potential that we will be subject to penalties. – Flex Mussels owner Bobby Shapiro.

The winners in life are proactive and reactive. If your food truck, restaurant or bar are not under an audit there is nothing to worry about, right? Nope, dead wrong! Do not wait until your restaurant is selected for a sales tax audit. Planning ahead can help your business in so many ways.

Food and beverage sales are subject to complex tax rules in New York. Failing to pay sales tax can lead to severe consequences

Penalties and interest as high as 14.5% may be imposed for failing to pay sales tax. Your business could also have its Certificate of Authority revoked or face criminal prosecution. In some cases, certain owners, officers, directors, employees, partners or members (responsible persons) of a business can be held personally liable for the sales tax owed by the respective business. The State may pursue collection and use any combination of enforcement methods such as warrants, levies, income execution and seizures to collect what is owed.One of the most problematic areas we see for many audited restaurants is recordkeeping. And, each state has different recordkeeping rules. Many restaurant operators fail to invest and maintain records, and those that do often do not maintain proper records. If your cash register or POS system is missing a detail – regardless of how minuscule the detail may seem to be- your restaurant can be vulnerable and exposed. Bookkeeping Chef can help make sure you are properly maintaining your books and records to support your sales tax reporting if you are ever selected for an audit.

Aside from sales tax audits, another area of worry is the amount of taxes being collected. Failing to collect enough sales tax can lead to a sales tax assessment. Collecting too much sales taxes can put you at a competitive disadvantage compared to other hospitality businesses in your industry who are more aware of what is subject to sales tax and what is not subject to sales tax. We can review the taxability of the food and drink you sell to make sure you are charging sales tax correctly.

So, say you are not subject to an audit but realize there has been a collection or remittance issue? Bookkeeping Chef can assist in these situations as well. By knowing what options are available to businesses in your situation, we can work with you to determine the best way to remedy a problem before it becomes hemorrhaging.

Don’t wait until your audit, get our complimentary sales tax compliance audit analysis today.

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][mk_button size=”xx-large” bg_color=”#dd3333″ icon=”mk-li-umbrella” url=”https://bookkeepingchef.com/request-a-quote/” target=”_blank” align=”center”]Request a Free Sales Tax Audit Analysis [/mk_button][/vc_column][/vc_row]