Lets face it, the New York City restaurant industry is fiercely competitive. You have the burning desire to succeed and fill up your tables every night. You may think your place has the best food, but you know that running a profitable food establishment entails a lot more than just a talent for grilling and love for hospitality. Choosing a good location, having a solid business plan, organization, and the discipline to keep accurate financial records are also crucial factors in whether or not your restaurant will fail or make it.

To better understand restaurant bookkeeping components, and the type of software that may work best for your particular business, check out these restaurant accounting tips so that you may make an informed decision to manage your financial data.

Let’s start by saying that bookkeeping is the backbone of running a restaurant. Restaurant managers may it find it a little overwhelming to try to keep track of the books along with managing the staff. Even if you did not graduate from college with an accounting degree, the concept of restaurant bookkeeping is pretty simple if you can train your mind to be organized. An owner cannot operate successfully if you don’t know:

- Where you are spending your money?

- How much money is being spent?

- Where and how much revenue is coming in each month?

- What are your inventory costs and margins?

- How much money do you need to make to cover payroll, overhead, and still earn a profit?

[vc_row][vc_column][vc_btn title=”Request a Consultation to Get Started” style=”classic” color=”warning” size=”lg” align=”center” link=”url:http%3A%2F%2Fbookkeepingchef.com%2Frequest-a-quote%2F||target:%20_blank”][/vc_column][/vc_row][vc_row][vc_column][vc_column_text]

1. Ask other restaurant owners and use Google

You can search on Google for “restaurant accounting software” and read reviews. You can also talk to other business owners to find out how they handle their books. Do they use a particular software or employ an in house bookkeeping staff? Or does their CPA help them with it?

2. Keep track of Daily Sales

The only way you are going to know if your restaurant is in the red or black each week is by keeping an accurate record of sales; how much cash is coming in and going out. This may sound obvious, but you will be surprised that many anxieties associated from money stem from a lack of dedication to record keeping. The best accounting software will connect with your POS system. It will also be able to track sales by each server while monitoring food, bar, and gift certificate sales.

3. Keep Track of Your Restaurant’s Expenses

Your hospitality business expenses can include payroll, labor costs, food and alcohol inventory, rent, insurance and occupancy expenses.

- Study your inventory costs: how much you purchase each week, and your cost of goods sold.

- Log and document how you pay your employees.

- Become familiar with your operational expenses. This will be helpful when you or your accountant compiles a quarterly or annual financial statements.

These figures will help you figure out how much income needs to be generated to make payroll and earn a profit. The right kind software will help you monitor your purchases while staying in compliance with New York State’s income tax laws. The right bookkeeping software can help you save ample time for refining menu offerings and experimenting with new dishes while still ensuring a steady profit.

4. Hire a Restaurant CPA

There are a lot cloud-based accounting software programs out there, and many of them can have a difficult learning curve at first. When looking at tools like Quickbooks or Xero, having a good accountant on your team can make the world of difference in terms of managing your bookkeeping and ultimately yearly tax filings. Some are even certified QuickBooks Pro Advisors. Remember, keeping accurate books year round is really important for your CPA to maximize legitimate deductions for your business. This saying rings true in this case,

paying less taxes is exactly the same as making more money. – Scott Aber CPA

5. Point of Sale Systems

Point of Sale (POS) systems are computer systems used by restaurants and bars so that servers can record orders and complete payment transactions. When it comes to managing your numbers, many sophisticated POS systems let you track inventory counts, labor costs, methods of payment and even run sales reports. Some popular POS software systems are Square, ShopKeep and QuickBooks. Do some research, but make sure that the accounting software you end up choosing will integrate and pull the data from the POS.

A good software will do this for you:

1. Streamline your Data entry tasks

Almost nothing in the world can seem more time consuming and monotonous than having to manually enter data into a system each week. Well designed bookkeeping software will be easy to use and will alleviate some of this process by categorizing and generating the right fields while you are typing. Bookkeeping Chef’s software makes it easy for you. All you need to do is take pictures of your receipts and easily import your expenses from your bank accounts.

This saves you time from having to do it yourself or paying someone from your staff to deal with it. By automating the reconciliation process of credit and bank accounts you will have 24/7 access to your financial data on any device so that you can see what your cash flow is at all times.

This saves you time from having to do it yourself or paying someone from your staff to deal with it. By automating the reconciliation process of credit and bank accounts you will have 24/7 access to your financial data on any device so that you can see what your cash flow is at all times.

2. Keep Track of Revenue

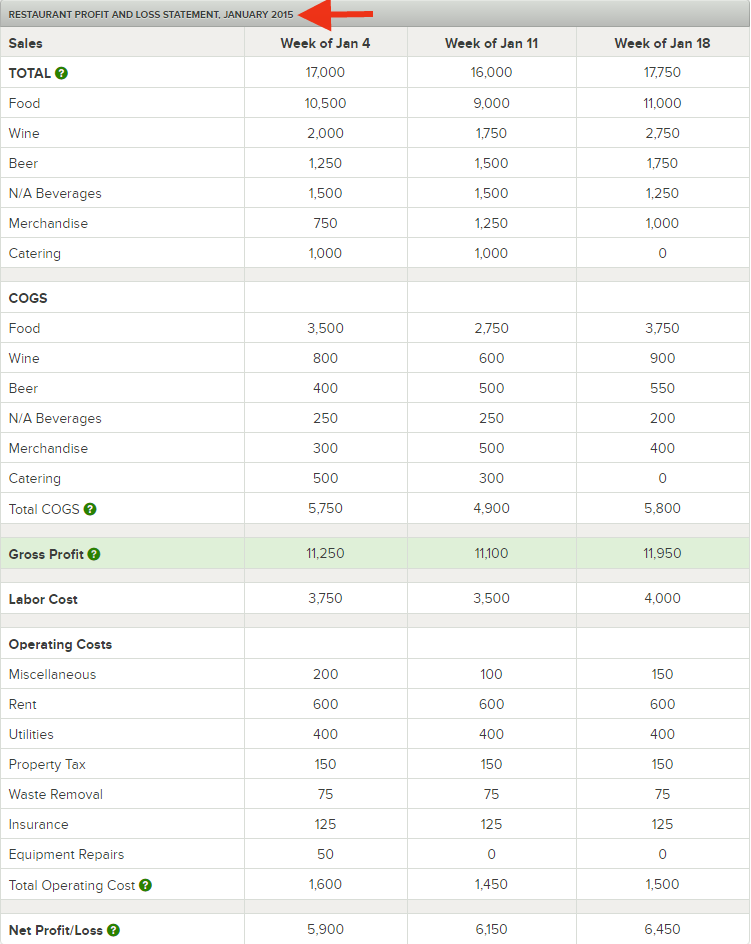

Keeping track of you of your restaurant’s revenue is just as important as watching your expenses. To figure out your revenue you need to keep weekly records of of how income is earned from food sales, drink sales, merchandise and even private catering gigs. If you don’t track or you underestimate your weekly revenue, then your company could look like it is losing money when it might not be. It can also go the other way, if you overestimate your income, you can run the risk of going over your weekly budget because you did not have control over your cash flow and spending limits.

3. Create Profit and Loss Statements

A profit and loss statement (P&L) that is specifically geared towards restaurants is another way to keep track of your labor costs, operating expenses, food costs and revenue. A P&L keeps all your restaurant’s accounting info organized in a succinct document that can be customized to fit your company’s needs. If you choose this method to organize your books, it is recommended that you use financial software that shows and easily breaks down all of your costs and revenue in layman’s terms for non accounting types. You can have them generated weekly, monthly or annually.

Hopefully now after reading this post you can begin to start organizing your data, by selecting an easy-to-use business cloud accounting solution so that you can develop a comprehensive understanding of your restaurant’s financial picture.

Hopefully now after reading this post you can begin to start organizing your data, by selecting an easy-to-use business cloud accounting solution so that you can develop a comprehensive understanding of your restaurant’s financial picture.

Here is a final checklist of some of things hospitality businesses would benefit from when choosing bookkeeping software. It should have:

- Robust Reporting – it should generate detailed financial reports

- Data Accessibility – You should be able to access your data anytime and anywhere thru the cloud

- Ease of Use – it should relatively easy to set and use

- Future Proofed – the software system you choose today should not be obsolete tomorrow

[/vc_column_text][/vc_column][/vc_row][vc_row][vc_column][vc_cta h2=”Researching bookkeeping systems may seem a bit overwhelming, ” h4=”but making the right choice now can save you a ton of time and money later down the road.” txt_align=”center” style=”flat” color=”turquoise”]Bookkeeping Chef is here to help NYC restaurants use cloud technology software to automate and streamline bookkeeping tasks such a payroll, financial reports and cash flow management. Request a free consultation to get started.[/vc_cta][/vc_column][/vc_row]

3 Responses

Great tips on restaurant bookkeeping. All very good points and I’ve sent this to several people. Sharing on my Facebook as well. 🙂

I prefer cloud-based bookkeeping software like SlickPie because it allows me to interact easily with clients who aren’t local. It’s free online accounting software. It offers core resources to fit my business demands such as – MagicBot for automatic data entry, sales tax management, auto recurs to regular clients and unlimited support services and more. It’s automatic functions saves me time and money.

Many restaurants manage their business basics using accounting software. If you’re looking for an accounting solution that is heavy on features that will enhance customer experiences and perhaps a little light on back-end features. I recommend to Bearbuk online accounting software. They provide billing, stock management, multi user, accounting, expense management and more. https://www.bearbuk.com